Our sector

International purchase order funding

Sectors, we experts

At Oriberg, our trade credit services help importers and traders access flexible credit lines, set up new limits, transfer existing credit, and secure supplier payments. We serve businesses in the UAE, UK, and USA, giving you tools to trade smarter and grow faster.

Apply for a Credit Line

Hardware & Software Finance

Flexible Credit Solutions for Technology, Construction, Telecoms, PPE & Electronics

At Oriberg, we support importers, suppliers, and technology-driven businesses with tailored finance solutions for machinery, equipment, and IT assets. Whether you’re acquiring tech products, electronics, PPE, or construction gear, we help structure flexible trade credit and asset-backed funding to meet your operational and cash flow needs.

With our in-depth industry expertise and access to a wide network of lenders, we ensure our clients get the right financing partner — especially when it comes to hard-to-value technology and specialist assets.

Hardware

Smartphones, VOIP systems

Laptops, desktops, servers

Routers, switches, PDAs, UPS systems

Monitors, LCD displays, digital signage

Scanners, printers, EPoS systems, tablets

Interactive boards, cabling, CCTV, peripherals

Software

Subscription-based platforms

Perpetual licences & hosted systems

Term-based software deals

Specialist software solutions (e.g. ERP, POS, CRM)

Cloud-based services and automation tools

IT Services

Support and managed service contracts

Software and infrastructure installation

Web design, e-commerce platforms

IT consultancy and training

Finance Requirements

To qualify, your company should:

Be established and creditworthy

Require a hardware/software financing facility

Have eligible trade needs (import/export, operations, etc.)

Commodity Finance (SIC 19)

Flexible Finance for Metals, Energy & Agriculture Commodities

Oriberg offers structured commodity finance to help producers, traders, and distributors fund global commodity transactions—covering metals & mining, energy, and soft commodities. We work with trusted lenders who understand the complexities and risks of cross-border trades and low-margin products.

Key Features:

Pre-export, countertrade, barter & inventory finance

Funding for metals, energy, agri & soft commodities

Risk-managed solutions for volatile markets

Support for new, growing & established traders

Custom finance based on receivables, cash cycles, and trade flows

Works for producers, processors, and distributors

Insurance-backed security options

Global reach including UAE, UK, USA, and developing markets

Why Choose Oriberg:

We collaborate with funders who can enforce asset-backed lending

Our expertise ensures access to trusted commodity lenders

Reduce country risk & improve liquidity

Expand into new markets confidently

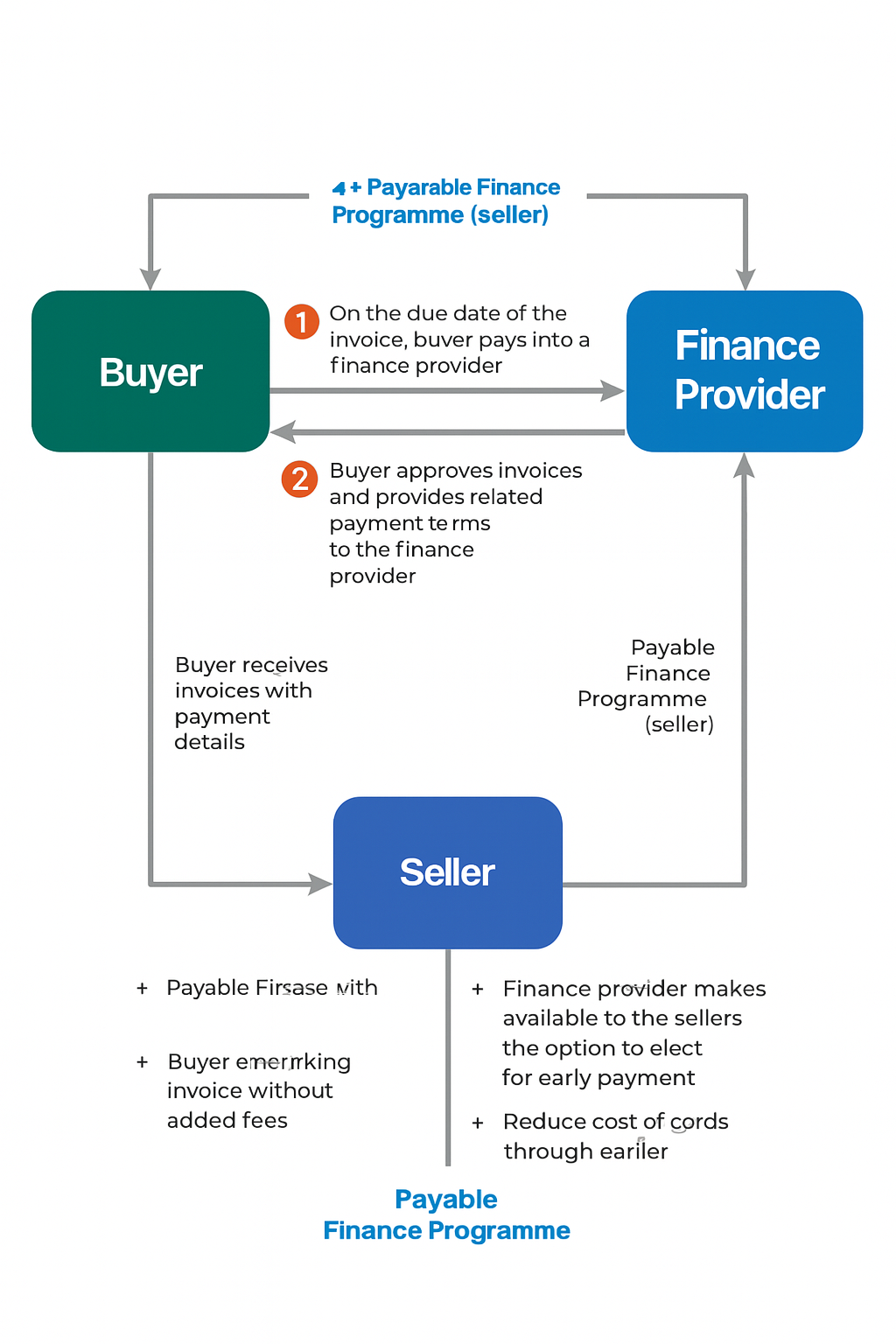

Supply Chain Finance

Free Up Cash Flow in Global Supply Chains

Oriberg offers flexible Supply Chain Finance (SCF) solutions to help importers and buyers unlock trapped working capital, improve supplier relationships, and streamline international trade.

With SCF, suppliers get paid early, and buyers can extend payment terms — all while reducing financing costs and improving cash flow.

Also known as:

Supplier Finance, Payables Finance, Reverse Factoring, Approved Payables, Confirming

How It Works

Buyers work with Oriberg to approve supplier invoices for early payment via our finance network. Suppliers receive early funds, while buyers maintain longer payment cycles — without needing bank loans or disrupting credit lines.

Benefits for Buyers

Preserve working capital

Improve supplier trust and delivery timelines

Buy in bulk and negotiate better terms

Reduce the cost of goods through early payments

Manage complex supply chains efficiently

Strengthen balance sheet without new debt

Benefits for Suppliers

Get paid faster without added fees

Access liquidity without loans

Reduce payment risk and delays

Work on more deals in parallel

Use buyer’s strong credit profile to secure early payment

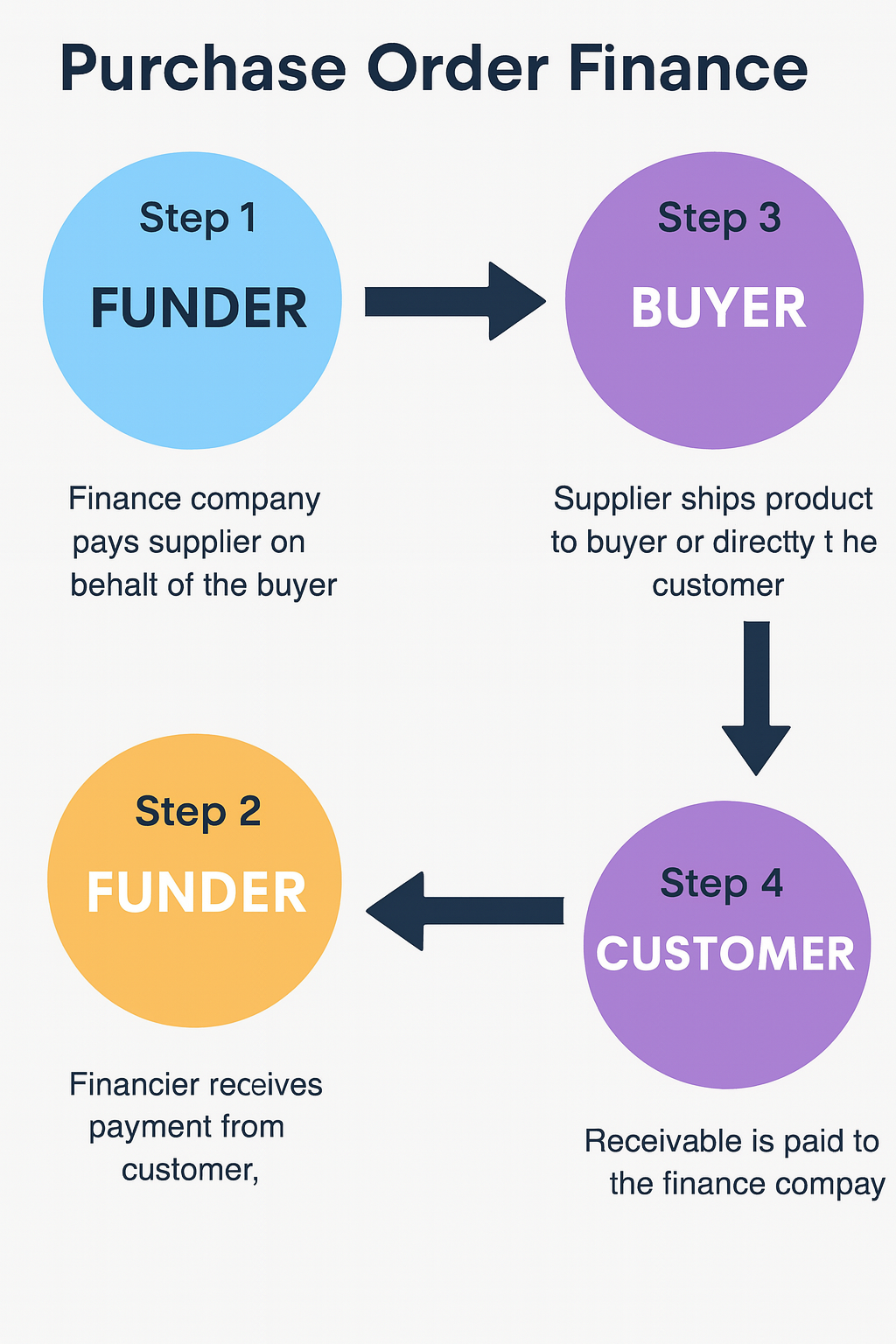

Purchase Order Finance

What is Purchase Order Finance?

Purchase Order (PO) Finance is a smart funding solution for trading businesses that need to fulfil large orders without tying up their cash flow. It helps companies buy goods from suppliers to fulfil confirmed customer orders — without needing upfront capital.

This short-term finance option is ideal for businesses that lack the cash to pay suppliers but have secured a confirmed order from a reputable buyer.

It’s especially useful for:

Import/export companies

Wholesalers

E-commerce sellers

Manufacturers with global suppliers

PO Finance often works alongside Invoice Finance, where the lender is repaid once goods are delivered and invoiced.

Key Benefits:

Key Benefits:

Fulfil large orders without upfront capital

Strengthen supplier and buyer confidence

Improve cash flow and order capacity

Avoid dilution from equity investment

Boost growth without long-term debt

Build credibility with global suppliers

No need for asset collateral

Ideal for fast-moving trade deals

Purchase order finance, PO finance solutions, trade finance for importers, international purchase order funding, supplier payment financing, purchase order funding UAE, purchase order finance UK, purchase order finance USA, global PO financing, pre-shipment finance, how does purchase order financing work, funding purchase orders for international trade, best PO finance providers in UAE, purchase order finance for importers and exporters, supplier financing with no upfront payment, trade credit via PO financing, end-to-end purchase order funding solutions, flexible purchase order finance for SMEs, finance company pays supplier directly, buyer-based PO finance program